Ytd paycheck calculator

Ytd net pay calculator Jumat 02 September 2022 Take those. Input year to date income.

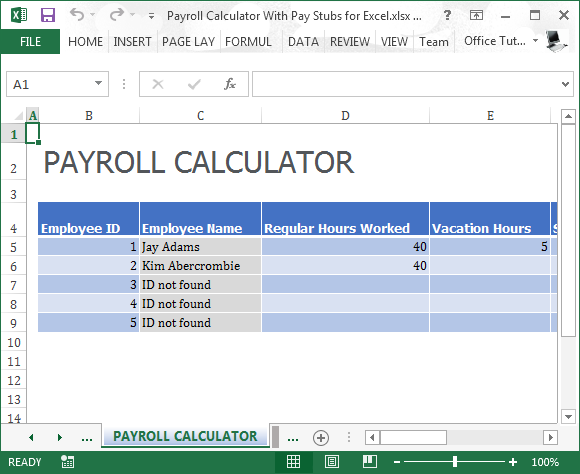

Payroll Calculator Free Employee Payroll Template For Excel

A table will be created that you can copy and.

. Enter the year-to-date income in the YTD box then choose the start and finish. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Please use the Base Pay Calculator for pay periods ending on or before 315.

Input day of month on paystub as number. Enter Employee Details like Name Wages and W-4 information. Michelle earned a total of 40000 in gross income YTD while Ada earned 36000 Mia earned 42000 Chris earned 28000 and Van earned 47000.

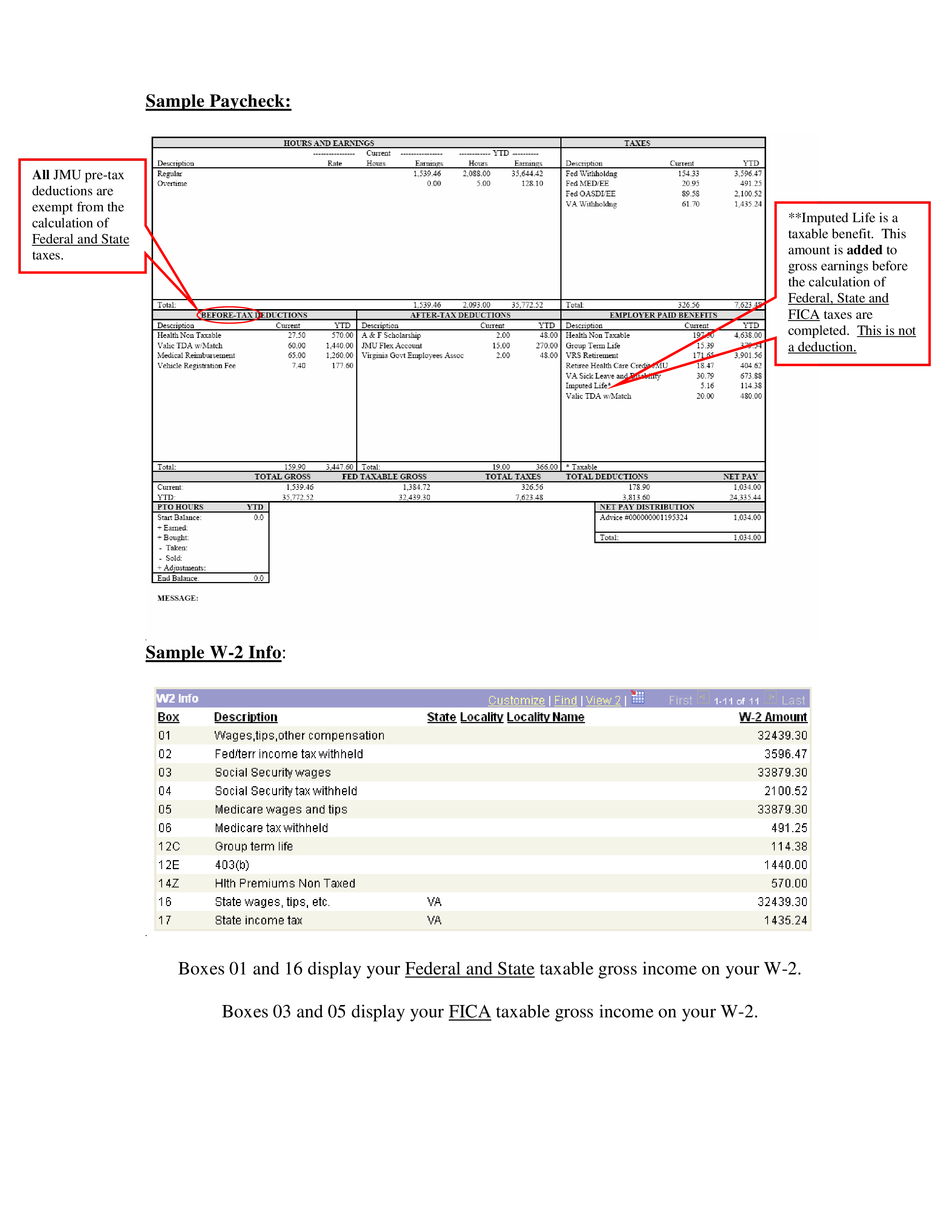

Pay Period End Date cannot be within 90 days of Hire Date. The state tax year is also 12 months but it differs from state to state. Last but not the least YTD Net Pay which is the subtraction of YTD Deduction amount from YTD Gross.

Free for personal use. Pay Type Hours Prior YTD CP. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Add up all five year-to-date. Year to Date Income.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Get a quick picture of estimated monthly income. This paystub creator allows you to simply type in your basic pay numers like wage and hire date and we will calculate the rest including witholding taxes deductions loans etc.

Check stub creator free paycheck calculator online paystub. Enter the information from the pay stubs before and after the missing pay stub in the fields below and click the Calculate button. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Computes federal and state tax withholding for. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. For example if an employee receives 500 in.

CONVERT YEAR TO DATE INCOME TO MONTHLY. This online calculator is excellent for pre-qualifying for a mortgage. Enter Company Details like Name EIN Address and Logo.

Input month on paystub as number. For example if the period. Some states follow the federal tax.

Free for personal use. Free for personal use. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Please enter a value for Verified Hire Date. A paystub generator with YTD calculator. The procedure is straightforward.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

What Does Ytd On A Paycheck Mean Quora

Hrpaych Yeartodate Payroll Services Washington State University

Hourly Paycheck Calculator Step By Step With Examples

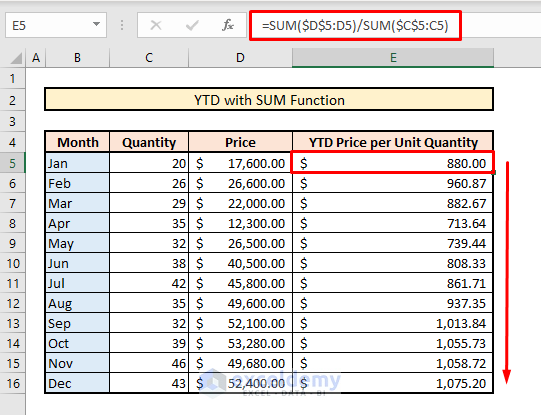

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Paycheck Calculator Apo Bookkeeping

Paycheck Calculation Templates At Allbusinesstemplates Com

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Annual Bi Weekly Timecard Payroll Calculator Etsy Canada

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Set Up The Payroll With Ytd Amounts

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

How To Enter Ytd Payroll Data